Using budgeting assumptions when preparing the master budget plays a pivotal role in enhancing the accuracy and reliability of financial plans. This practice involves incorporating reasonable estimates and forecasts into the budgeting process to account for uncertainties and potential risks.

By utilizing various methods for developing and evaluating assumptions, organizations can create more effective and adaptable master budgets that guide their financial decision-making.

The significance of budgeting assumptions lies in their ability to improve the credibility of master budgets. Assumptions provide a framework for anticipating future events, such as economic conditions, sales trends, and cost structures. This enables organizations to make informed decisions based on well-reasoned projections, reducing the likelihood of significant deviations from actual results.

Overview of Budgeting Assumptions

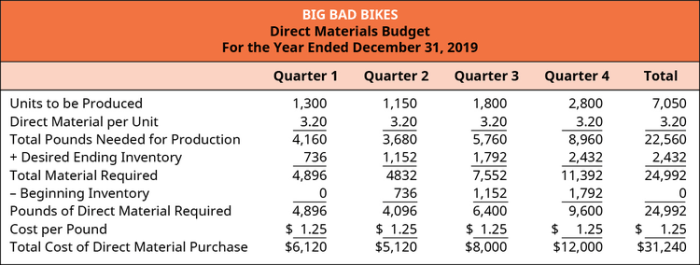

Budgeting assumptions are critical to master budgeting, as they provide the foundation for financial projections and decision-making. These assumptions include economic, sales, and cost assumptions, and they influence the accuracy and reliability of the master budget.

Benefits of Using Budgeting Assumptions, Using budgeting assumptions when preparing the master budget

Budgeting assumptions enhance the accuracy of master budgets by providing a framework for forecasting and anticipating future events. They identify potential risks and opportunities, enabling businesses to prepare and mitigate risks or seize opportunities.

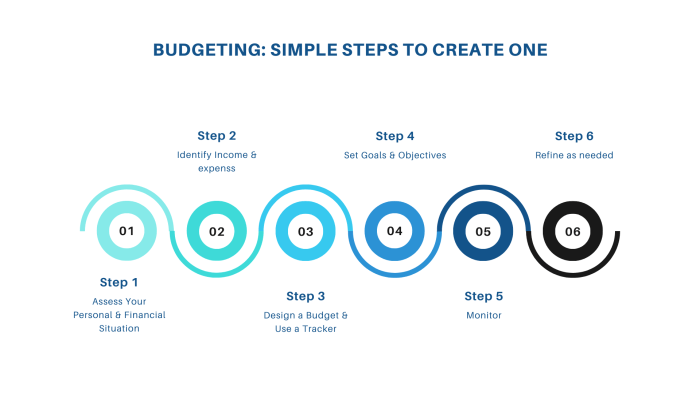

Methods for Developing Budgeting Assumptions

Developing budgeting assumptions involves gathering and analyzing data. Historical data analysis, industry research, and expert consultations are common methods used to establish realistic and well-supported assumptions.

Considerations for Effective Budgeting Assumptions

Effective budgeting assumptions are realistic, well-supported, and subject to ongoing monitoring and review. Assumptions should align with industry trends, economic indicators, and company-specific factors to ensure their validity.

Common Challenges in Using Budgeting Assumptions

Developing and using budgeting assumptions can present challenges, including uncertainty, bias, and lack of data. To overcome these challenges, businesses can employ sensitivity analysis, conduct regular reviews, and incorporate contingency planning.

Best Practices for Using Budgeting Assumptions

Effective use of budgeting assumptions requires documentation, communication, and contingency planning. Assumptions should be clearly documented, communicated across the organization, and reviewed periodically to ensure their relevance and accuracy.

Commonly Asked Questions: Using Budgeting Assumptions When Preparing The Master Budget

What are the benefits of using budgeting assumptions?

Budgeting assumptions enhance the accuracy and reliability of master budgets, facilitate risk identification and opportunity analysis, and provide a basis for informed decision-making.

How are budgeting assumptions developed?

Budgeting assumptions can be developed through historical data analysis, industry research, expert consultations, and scenario planning.

What are common challenges in using budgeting assumptions?

Challenges include uncertainty, bias, lack of data, and the need for ongoing monitoring and review.